CCChecker - Ensuring The Validity Of Credit Card Information

Whether it's purchasing goods or subscribing to services, credit cards have become an essential tool for conducting business over the internet. However, with the rise in online fraud and identity theft, it has become crucial to implement robust security measures to protect both businesses and consumers. This is where CCChecker comes into play.

Author:Buttskin FamilyReviewer:Caden SteelheartMay 27, 20233.2K Shares271.6K Views

Whether it's purchasing goods or subscribing to services, credit cards have become an essential tool for conducting business over the internet. However, with the rise in online fraud and identity theft, it has become crucial to implement robust security measures to protect both businesses and consumers. This is where CCCheckercomes into play.

CCChecker, short for Credit Card Checker, is a powerful tool that allows merchants and individuals to validate credit card information before processing transactions. It verifies whether a given credit card number is valid and whether it corresponds to the cardholder's name and other crucial details.

The Importance Of CCChecker

One of the primary purposes of CCChecker is to identify invalid credit card numbers. By utilizing a combination of checksum algorithms and industry-specific rules, CCChecker can quickly determine if a credit card number is mathematically valid.

This validation process is crucial for preventing the submission of incorrect or mistyped credit card information, saving both businesses and consumers from unnecessary complications.

Beyond just checking the validity of credit card numbers, CCChecker goes a step further by verifying cardholder information. It cross-references the provided card number with the associated cardholder's name, expiration date, and other pertinent details.

This verification process ensures that the person attempting the transaction is the rightful owner of the credit card. By confirming the authenticity of the cardholder's information, CCChecker significantly reduces the risk of fraudulent activity.

How CCChecker Works

CCChecker employs advanced algorithms to verify the mathematical validity of credit card numbers. These algorithms utilize a combination of mathematical operations, such as checksum calculations and modulus checks, to ensure that the structure of the credit card number adheres to the specifications defined by the card issuer.

If any discrepancy is found, CCChecker flags the card as potentially invalid, prompting further investigation. In addition to algorithmic validations, CCChecker also relies on extensive databases of credit card information.

These databases contain records of valid credit card ranges and associated metadata, including issuer identification numbers (IINs), card brand information, and validation rules specific to each card issuer. CCChecker utilizes this data to validate the authenticity of credit card numbers and to match them with the corresponding cardholder information.

Implementing CCChecker

Integration with payment gateways is a crucial aspect of implementing CCChecker effectively. By seamlessly integrating CCChecker into the payment gateway infrastructure, businesses can ensure that every transaction is validated for credit card authenticity and protect themselves from potential fraudulent activities.

Integration With Payment Gateways

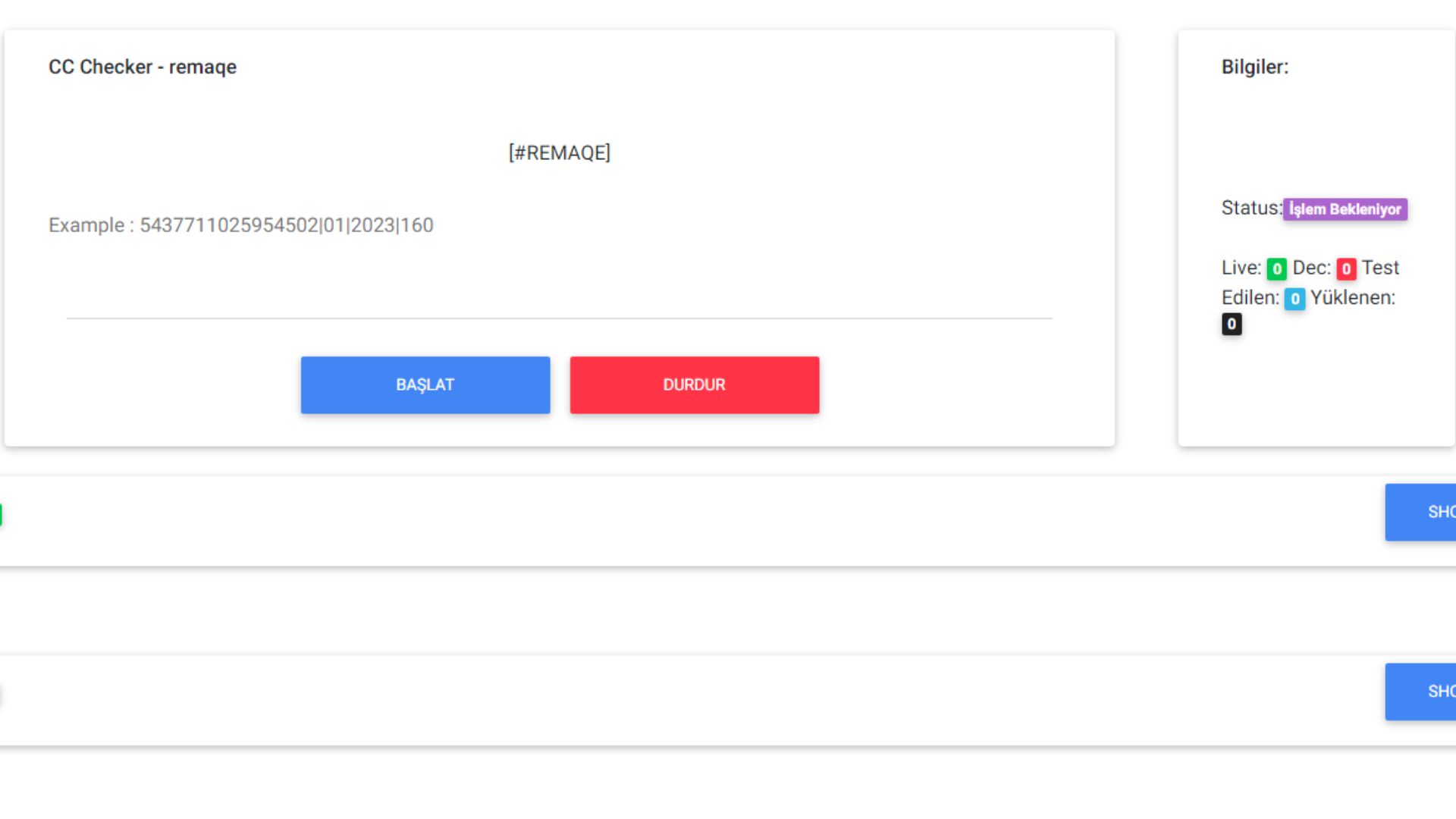

To maximize its effectiveness, CCChecker can be integrated into various payment gateways and online platforms. When a user enters their credit card information during the checkout process, CCChecker is invoked to validate the provided data.

If CCChecker identifies any issues or inconsistencies, the payment gateway can prompt the user to review and correct the information before proceeding with the transaction. This integration not only protects the merchant from potential chargebacks but also enhances the overall user experience by minimizing errors and rejections.

Developer APIs

CCChecker also offers developer APIs that allow businesses to integrate the service directly into their own applications or websites.

By leveraging these APIs, developers can seamlessly incorporate CCChecker's validation capabilities into their existing payment workflows. The APIs provide a convenient and efficient way to verify credit card information without the need for extensive manual validation or the risk of exposing sensitive data.

Reducing False Declines And Transaction Errors

CCChecker plays a vital role in reducing false declines and transaction errors, which can significantly impact both businesses and customers. False declines occur when legitimate transactions are mistakenly flagged as fraudulent and rejected.

This can lead to frustrated customers, lost sales, and damage to the merchant's reputation. By integrating CCChecker into the payment process, businesses can minimize false declines by accurately validating credit card information and ensuring that legitimate transactions are not mistakenly blocked.

CCChecker's advanced algorithms and database lookup enable it to perform thorough validations, including checking the card's validity, verifying cardholder information, and cross-referencing with known fraud indicators. By leveraging these capabilities, CCChecker can accurately identify and approve legitimate transactions, reducing the occurrence of false declines.

Moreover, CCChecker also helps prevent transaction errors by validating the accuracy of credit card information during the checkout process.

It checks for mistyped or incorrect card numbers, expiration dates, and other essential details, minimizing the chances of transaction failures due to input errors. By catching and prompting users to correct such errors, CCChecker helps ensure smooth and error-free transactions, enhancing the overall customer experience.

The Impact Of CCChecker On Chargeback Prevention

Chargebacks can be a significant concern for businesses, leading to financial losses and administrative burdens. Chargebacks occur when customers dispute transactions and request a refund from their credit card issuer.

CCChecker plays a crucial role in chargeback prevention by minimizing the occurrence of fraudulent transactions and ensuring the validity of credit card information. By validating credit card numbers and cross-referencing cardholder information, CCChecker helps identify potentially fraudulent transactions before they are processed.

This proactive approach reduces the likelihood of chargebacks resulting from unauthorized or fraudulent use of credit cards. By detecting suspicious activities early on, CCChecker allows businesses to take appropriate measures, such as declining the transaction or requesting additional verification, to prevent chargebacks from occurring.

Additionally, CCChecker's integration with payment gateways provides an added layer of protection against chargebacks.

When CCChecker identifies a potentially high-risk transaction, it can prompt the payment gateway to apply additional security measures, such as requiring the customer to provide additional authentication or proof of identity.These measures help ensure that the transaction is legitimate and reduce the risk of chargebacks.

Video unavailable

This video is unavailable: Original link to video

Enhancing Data Privacy With CCChecker's Secure Validation

Data privacy is a critical concern in today's digital landscape. Customers are increasingly conscious about the security of their personal information during online transactions. CCChecker addresses these concerns by incorporating secure validation methods that prioritize data privacy and protect sensitive customer information.

CCChecker employs encryption and secure communication protocols to ensure that credit card information is transmitted and processed securely.

The integration with payment gateways and developer APIs follows industry best practices for data protection, including compliance with relevant security standards such as the Payment Card Industry Data Security Standard (PCI DSS).

When customers submit their credit card information for validation, CCChecker processes and verifies the data without storing or retaining any sensitive information.

This approach minimizes the risk of data breaches or unauthorized access to credit card details. By adopting this secure validation approach, businesses can instill confidence in their customers, assuring them that their data privacy is a top priority.

CCChecker APIs - Seamless Integration For Developers

CCChecker offers developers a range of Application Programming Interfaces (APIs) that enable seamless integration of its validation capabilities into their own applications and websites. These APIs provide developers with a convenient and efficient way to incorporate CCChecker's advanced credit card verification functionality, enhancing the security and reliability of their payment processes.

With CCChecker APIs, developers can integrate credit card validation directly into their existing systems, streamlining the validation process and reducing manual efforts. The APIs allow developers to send credit card information to CCChecker's server and receive real-time validation results, including the card's validity, verification of cardholder details, and detection of potential fraudulent activities.

CCChecker APIs offer flexibility and customization options, allowing developers to tailor the integration according to their specific requirements. Developers can choose from a variety of API endpoints and response formats, making it easy to integrate CCChecker into different programming languages and frameworks.

The Future Of CCChecker

As online fraud techniques continue to evolve, CCChecker is expected to evolve as well. Future iterations of CCChecker may incorporate machine learning algorithms and artificial intelligence to enhance its fraud detection capabilities.

By analyzing patterns and identifying anomalies in credit card data, CCChecker could become even more effective in detecting fraudulent transactions and protecting businesses and consumers alike.

Expanded Cardholder Authentication

While CCChecker currently focuses on validating credit card numbers and associated information, future developments may introduce additional layers of cardholder authentication.

This could involve implementing two-factor authentication (2FA) or integrating with biometric technologies, such as fingerprint or facial recognition, to ensure the highest level of security. By combining CCChecker's existing validation capabilities with enhanced authentication methods, online transactions can become even more secure and trustworthy.

People Also Ask

Can CCChecker Detect Fake Credit Card Numbers?

CCChecker can identify potentially fake credit card numbers by validating their structure and cross-referencing with known valid card ranges.

Is CCChecker Suitable For Both Online And Offline Transactions?

While CCChecker is primarily designed for online transactions, it can also be integrated into offline payment systems for added security.

Does CCChecker Validate International Credit Cards?

Yes, CCChecker can validate credit cards issued by international banks, taking into account different validation rules and card formats.

Can CCChecker Detect Fraudulent Recurring Payments?

CCChecker can help identify discrepancies or anomalies in recurring payment transactions, aiding in the detection of fraudulent activities.

Does CCChecker Store Credit Card Information?

No, CCChecker does not store credit card information. It processes the data securely and does not retain any sensitive card details.

Conclusion

In an era where online transactions have become the backbone of commerce, the importance of ensuring the validity of credit card information cannot be overstated. CCChecker serves as a powerful tool in the fightagainst online fraud and identity theft.

By verifying the mathematical validity of credit card numbers and cross-referencing cardholder information, CCChecker provides a robust layer of security for businesses and consumers alike.

Jump to

The Importance Of CCChecker

How CCChecker Works

Implementing CCChecker

Reducing False Declines And Transaction Errors

The Impact Of CCChecker On Chargeback Prevention

Enhancing Data Privacy With CCChecker's Secure Validation

CCChecker APIs - Seamless Integration For Developers

The Future Of CCChecker

People Also Ask

Conclusion

Buttskin Family

Author

The Buttskins are a crazy author family who love writing, laughter, and eating an unhealthy amount of junk food. Mom Rockita started scribbling stories as soon as she could hold a pen, and Dad John didn't realize authoring children's books was a real job until after they were married.

Their kids have embraced storytelling at an early age. Little Lucy, age 5, dictates her colorful tales about dragons and princesses to her parents. Her 8-year old brother Jake collects scraps of paper to diagram his latest imaginary adventure involving ninjas and dinosaurs.

Caden Steelheart

Reviewer

Caden Steelheart, an enigmatic author, weaves tales that immerse readers in the depths of sin city's underbelly. With his words as a weapon, he crafts literary masterpieces that reflect the dark and dangerous spirit of the city. Caden's writing captures the gritty essence of sin city, delving into the intricacies of its characters and the moral complexities that define their existence.

Born amidst the shadows, Caden draws inspiration from the relentless chaos and unforgiving nature of the city. His words carry the weight of experience, creating a vivid and haunting portrayal of sin city's undercurrents. Through his stories, he explores the blurred lines between right and wrong, exploring themes of power, deception, and redemption.

Caden Steelheart's literary prowess has made him a name whispered in literary circles, captivating readers with his ability to immerse them in sin city's intricately woven tapestry. With each written word, he invites readers to journey into the darker realms of the human experience, offering them a glimpse into the secrets and sins that shape the city's inhabitants. Caden Steelheart, a master of capturing the essence of sin city through his writing, continues to captivate audiences with his haunting and evocative narratives.

Latest Articles

Popular Articles